Authors: Sarah Hoidn & Philipp Tombor

Market analysis: How digitalization drives change in the automotive aftermarket.

The automotive industry is undergoing radical change. Especially the car aftermarket, i.e. the business with spare parts and services, is being transformed by digitalization. The driving forces are digital distribution channels, new business models and connectivity. A market overview.

Preparing for the unknown

Anyone taking the car to the workshop for repair may be surprised at exorbitant spare parts prices. No wonder then that repairs and the trade in car parts account for a significant proportion of the total turnover of the automotive industry. Management consultants Roland Berger estimate that after-sales services account for up to 80% of manufacturers' total profits.

While the automotive market in Germany is stagnating, the business with spare parts and services offers great potential: Around 400 million vehicles, which are on average nine years old, have to be maintained and repaired in Europe alone - a market volume of around 248 billion euros.

And: The automotive aftermarket is growing worldwide. According to McKinsey, the market in China will grow most strongly worldwide until 2025 with 8.1% annually, whereas Europe with 1.5% and North America with 1.6% will show lower but still steady growth in comparison.

In Europe, five major purchasing associations [ATR, Temot International, ad international, Groupauto, VmA] have formed, which together achieve a turnover of more than 27 billion euros and cover almost all European countries. As the market offers attractive investment opportunities, private equity companies have been increasingly involved in acquisitions and investments since 2012.

Consolidations and new players are changing the automotive aftermarket

The market is experiencing an immense wave of consolidation. Competition leaders in Europe are internationally operating parts wholesalers who shape the market. At the same time, there is an increasing number of takeovers involving the biggest players, who buy smaller companies and are active among themselves. This results in scale and synergy effects. McKinsey estimates that 9 out of 10 of the top-selling still independent aftermarket dealers have been involved in consolidation activities in the last 5 years.

Compared to the USA, however, the European market still appears highly fragmented. The three largest aftermarket companies in Europe currently only have a 15% market share. In the USA it is already almost 50%. A development in the same direction is also apparent in Europe.

EXCURSION. Overview of the automotive aftermarket: OEMs, IAM & Co.

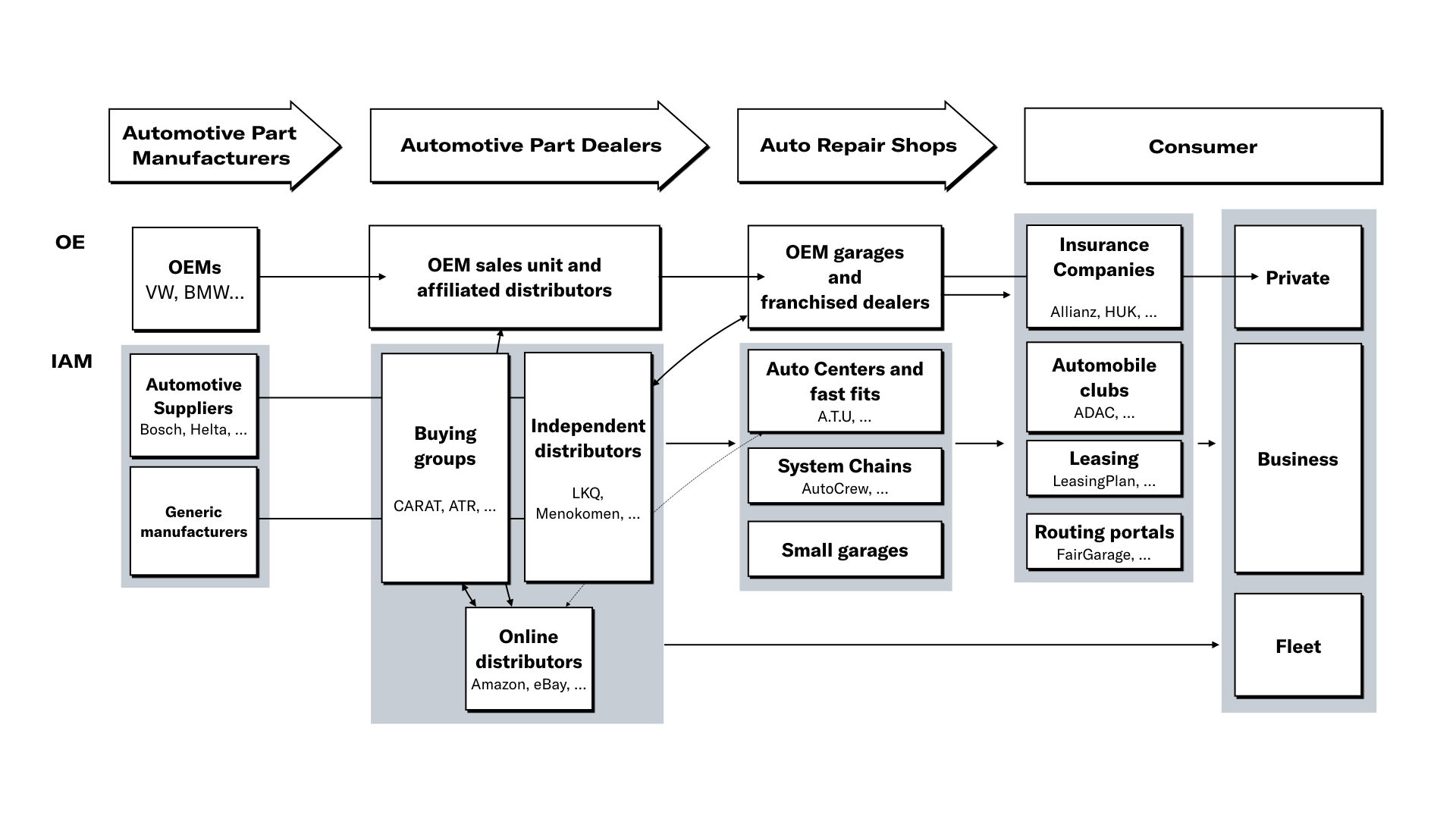

The aftermarket consists of the Original Equipment Manufacturer segment [OEM] and the Independent Aftermarket [IAM] [see Figure 1]. Both segments have their own distribution channels that reach the end consumer.

Compared to the OEM distribution chain, the independent aftermarket is more versatile. A much larger number of players are involved here, with manufacturers, dealers and workshops serving both classic and digital distribution channels. However, it is precisely the OEMs that are currently showing the greatest movement: they are aggressively pushing into the aftermarket.

Digitalisation is the most significant megatrend in the automotive parts industry

Roland Berger and HSH Nordbank AG speak of four megatrends for the parts market: mobility, autonomous driving, electrification and digitalisation. These developments are making the entire industry and its players more dynamic and increasing the need for action.

Digitalisation probably has the strongest influence on the transformation of the automotive parts industry. It is ploughing up entire business models, sales channels and services, right down to customer access and communication between customers and cars. The drivers are digital sales channels, new business models and connectivity.

Digital distribution

Even if the digital distribution of automotive parts is currently still low, rapid growth is expected: in the DACH region - Germany, Austria and Switzerland - the share of online sales is between only 5 and 12% of total sales. In the UK, by contrast, the share via online channels is already around 20%.

Kftzeile24.de is currently the largest online market participant [155 million EUR/2018] in Germany. This is followed by pkwteile.de, atu.de and atp-autoteile.de. On online marketplaces [such as Amazon and ebay Motors] spare parts are also sold, which primarily address end customers. As one can already assume, online purchases in the B2C sector are limited to low-tech products that are easy to install, such as windscreen wiper blades, light bulbs or filters. Cumbersome and major repair and maintenance work is left to the workshops, which also take care of ordering. Price-sensitive customers who buy parts themselves online and have them installed by a workshop are the exception.

New business models & intelligent cars

Trends in the automotive aftermarket are both a threat and an opportunity for established players - an opportunity if possibilities to integrate new technologies and business models are seized early; a threat if they are missed. Those who are prepared to act early and make strategic decisions will be successful in the long term.

Among the new digital developments are digital twins. This means that vehicles and their parts are mapped virtually, thus enabling continuous data exchange. This is complemented by automated inventory management, self-optimizing production and the Internet of Things [IoT].

For the aftermarket, IoT means: intelligent, Connected Cars that enable fully automated maintenance management. The American company CarForce, for example, offers cloud-based SaaS solutions for manufacturers and customers by providing real-time data and remote diagnosis.

The U.S. market research institute Gartner Inc. estimates that more than 250 million intelligently networked cars will be on the roads by 2020. In addition, there is great potential in fleet management using IoT.

Digitalisation enables new players [such as online dealers, insurance companies, automobile clubs or online platforms] to fill the niche between workshop and end customer with innovative business models. Currently a few large digital companies [especially Amazon and Google] dominate the IoT market and make it difficult for other players in the value chain to defend their position. In the coming years, new players are expected to enter the market, which will further shift the competitive pressure and significantly increase the need for action for established aftermarket players.

Software is increasingly becoming a central component of vehicles. McKinsey delivers an extreme scenario in which software expertise becomes not only competence but a core competence: Conventional and purely mechanics-focused workshops may no longer find a place in the future structures of the aftermarket.

As in all industries affected by digitization, service and customer focus are becoming increasingly relevant in the automotive industry. According to McKinsey, more than 50% of industry experts expect aftermarket services to become more important than the automotive parts themselves. Market participants who understand the customers and their needs create considerable competitive advantages for themselves. This has already been observed in other industries.

Market players must appeal more strongly to customers and need more service orientation

The automotive aftermarket in Europe is becoming increasingly consolidated and investment-driven. Shifts in profits are further accelerated by new [digital] players who, thanks to innovative business models, are occupying market niches and thus further increase competitive pressure.

Disruption along the value chain raises questions about the future of existing players: How can established market participants deal with change and act sustainably?

The automotive aftermarket is faced with the task of addressing and involving the end customer more strongly and of positioning itself in a more service-oriented manner. Both independent aftermarkets and OEMs would do well to reflect on their own business model in order to stay strategically and technologically up to date - and if not first then at least become second movers in the automotive aftermarket.